Every Texan dreams of the ever-elusive “Texas Tornado Super Bowl,” in which the NFL’s big game pits the two teams from Texas against each other on pro football’s biggest stage. Such a game would further brand Texas football as superior to the rest of the world.

In the 1992, it appeared that Texas football fans would get their wish. The Dallas Cowboys had the first-round bye in the playoffs, and the Houston Oilers opened the playoffs with a wild-card matchup against the Buffalo Bills.

The Bills were coming off of two straight Super Bowl losses, and a third consecutive trip to the big game was thought to be improbable. Houston, on the other hand, was a perennial contender, led by future Hall of Fame quarterback Warren Moon and flanked by receiver Haywood Jeffires.

The Houston Oilers jumped out ahead, quickly, amassing 35 points in the first half while only allowing the Bills 3. In the NFL in the early 1990s, such a score would have been considered a blowout as a final. As a halftime score, it was a bloodbath. No one expected the Bills to come back. No one.

The Bills, knowing that their season could soon be over, played their hearts out in order to save their pride. The Oilers. meanwhile, coasted, thinking that their 32-point cushion would suffice to carry them victorious into the locker room. The result was a Buffalo comeback which forced overtime, in which the Bills won 41-38, before advancing to the Super Bowl where they would lose their third straight championship match, this time to the Cowboys.

Two things defined that game. First, the Bills refused to surrender, and rejected the notion that any effort would be too little, too late. Second, the Oilers failed for lack of an end game. These two defining characteristics often arise in our own personal financial lives as well.

If you are a Baby Boomer or a member of Generation X, you probably did not have a lot of financial education when you were younger. If you did, it was likely so abstract that you had no idea how to implement a financial strategy, and even if you had one, following it meant dealing with financial advisors and insurance representatives, both of which could actually be barriers to achieving your goals.

As a result, we missed investment opportunities, got behind on our retirement savings, and failed to buy life insurance at a young age, resulting in us having to pay higher premiums in our middle age.

Such can be a discouraging experience, to the point that you might find yourself wondering what’s the point to starting now. Well, just like the 1992-1993 Buffalo Bills, second half comebacks are possible in the financial game of life.

On the other hand, some are able to leverage business opportunities, skills, and career preparation for high-income positions. They amass great wealth early on in life. They may purchase houses, vehicles, businesses and securities. On the surface, it looks like they are set for life, but like the Houston Oilers, without an end game, they can lose it all in the final 10 years.

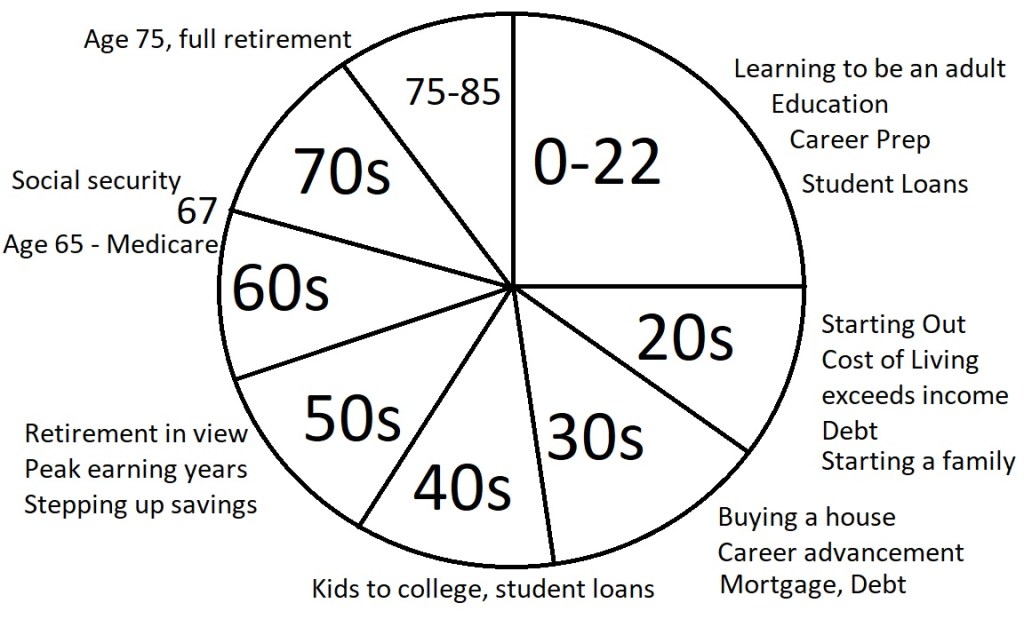

Consider the following chart, the “circle of life,” as I call it.

This circle of life follows the typical cycle of the American life. For the first 22 years, we are learning to be an adult, deciding what we want to be when we grow up, going to school, and learning that we want to make money.

From that point on, we build our lives, advancing our careers while buying houses, cars and boats, getting married, having children, taking on debt and doing the best we can. Ultimately, we retire, and the sun begins to set on our time here on earth.

Most Americans are collecting social security by the time they turn 67, but most don’t fully retire (for financial reasons) until age 75, and that’s usually because their health declines to the point that they are forced out of the workforce.

From age 75, until the average life expectancy of age 85, your life will be dominated by healthcare. You will likely face a seemingly endless barrage of clinical visits, tests, treatments, medications, and possibly in-home or nursing home care, or even hospice. While Medicare funds a lot of this, it does not fund it all. And without a plan, the costs of this care will consume everything you’ve worked for.

As your financial services firm, Acker Financial will help you form the plan to protect your assets in the final decade of life. We will help you plan and execute your end game. Furthermore, we will build near-term wins into the strategy, so that no matter where you are on the circle of life, you are protected from catastrophe and you are able to build some financial advantages into your portfolio.

If you would like to know more about how you can develop your end game and gain the advantage, fill out the contact form below. Please send me your name, email address, and any other information or questions you may have. I will be in touch and we can set up a time to talk.